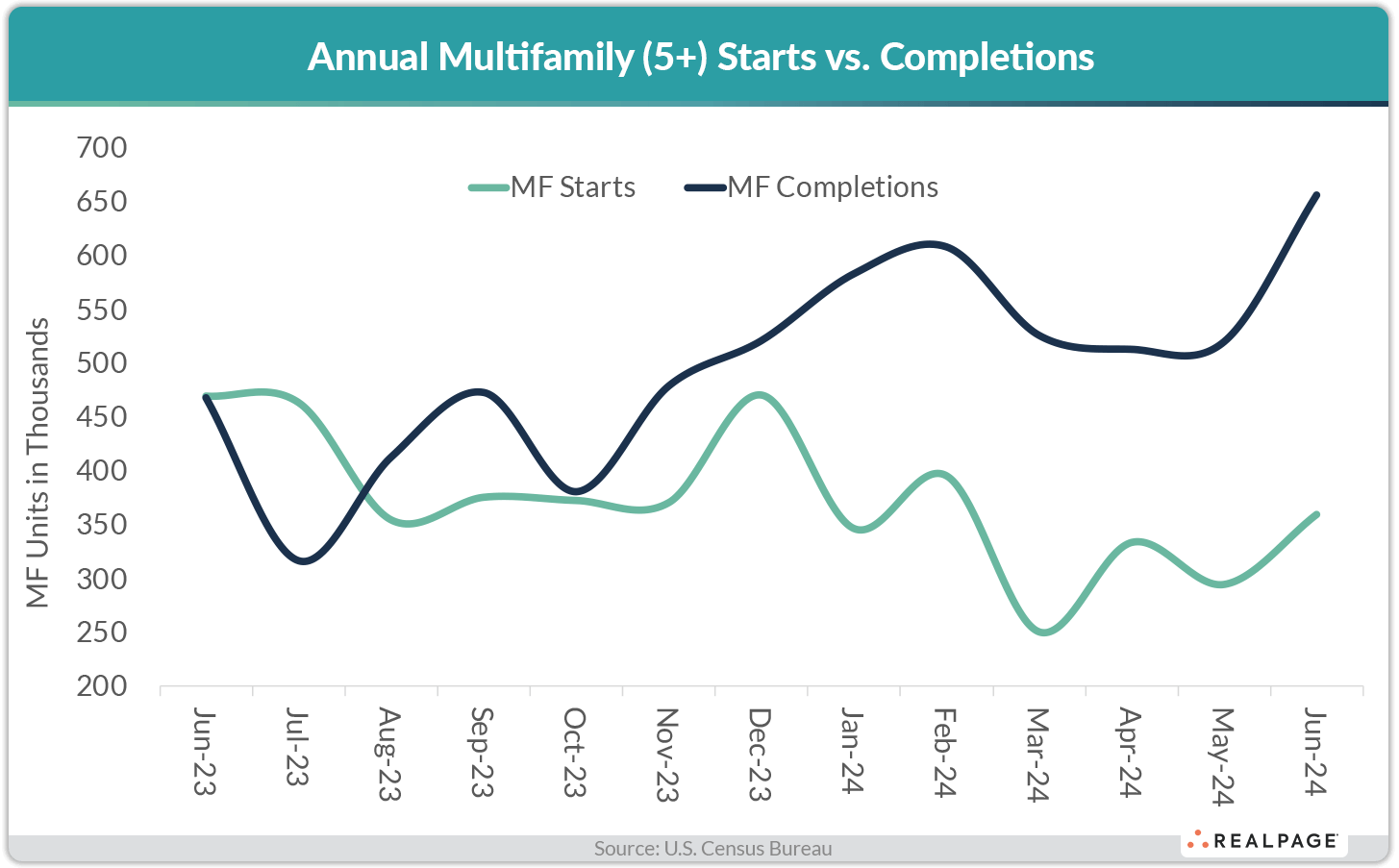

Annualized starts and permits for multifamily units unexpectedly increased sharply in June as these volatile housing measurements ran counter to their prevailing trends. However, multifamily completions are still running far ahead of both permits and starts.

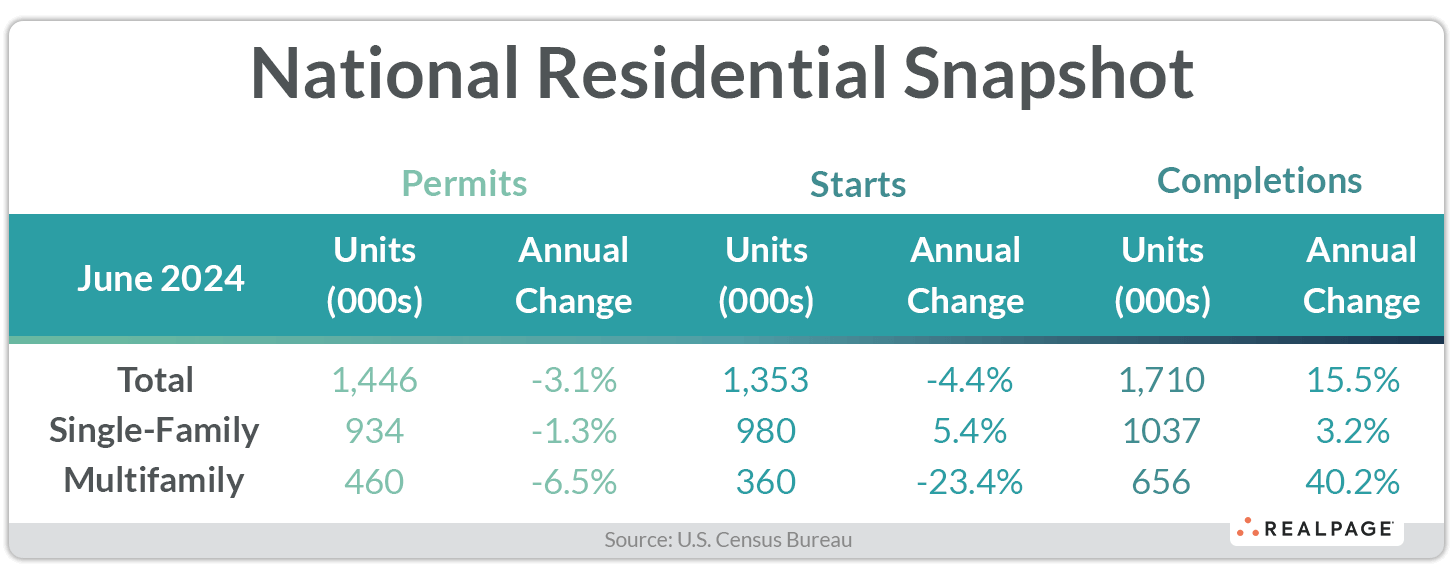

According to the latest report from the U.S. Census Bureau and the Department of Housing and Urban Development, the seasonally adjusted annual rate (SAAR) for multifamily starts shot up 22% from last month to 360,000 units and the annualized rate for multifamily permits increased 19.2% to 460,000 units. Compared to last June, permits are down 6.5% and starts are down 23.4%.

At the same time, the annualized rate for multifamily completions was almost double the rate for starts at 656,000 units, up 26.2% from May and 40.2% from last June. The spread between starts and completions continues to widen as the surge in multifamily construction of the past few years appears to be fading.

Additionally, the number of multifamily units currently under construction dipped 1.7% for the month to 880,000 units, down 11.4% from last year. The number of multifamily units authorized, but not started (which excludes cancelled, abandoned, expired and revoked permits) increased 3.1% from May to 131,000 units, but was unchanged from June of last year.

Meanwhile, at 980,000 units, single-family starts were down 2.2% from last month but up 5.4% for the year. May’s rate for starts was upwardly revised to 1.002 million units, leaving June’s pace as the first to drop below one million units since last October. The annualized rate for single-family permitting also declined for the month (-2.3%) and was 1.3% lower than last June at 934,000 units.

Single-family completions were up 1.8% for the month and up even more (3.2%) for the year to 1.037 million units. The number of single-family units under construction declined 1.3% from May to 668,000 units and was down 2.2% from one year ago. Single-family units authorized, but not started totaled 140,000 units, up 0.7% for the month, and like multifamily, were unchanged for the year.

Together with the small two-to-four unit figures, total residential permitting increased 3.4% from last month but was down 3.1% for the year to 1.446 million units. June’s increase in annual multifamily starts brought the SAAR of total residential starts up 3% from last month to 1.353 million units but the pace was still down 4.4% from last year.

Compared to one year ago, the annual rate for multifamily permitting decreased in three of the four Census regions. The deepest decline in annualized multifamily permitting occurred in the small Northeast region, which saw permits fade 24.9% to 43,000 units. Meanwhile, permit volumes in the West region declined 14% to 106,000 units and the Midwest region was down 3% to 74,000 units. The South region was virtually unchanged from one year ago with 237,000 units permitted. Compared to the previous month, permitting was up in the Midwest, South and West and down in the Northeast region.

Multifamily starts increased for the year in the Midwest (up 52.6% to 80,000 units) and Northeast (up 44% to 51,000 units). The South was down 44.7% to 138,000 units and the West was down 31.1% to 92,000 units. Compared to May’s SAAR, starts were down only in the South, up modestly in the West, doubled in the Midwest and tripled in the Northeast region.

Metro-Level Multifamily Permitting

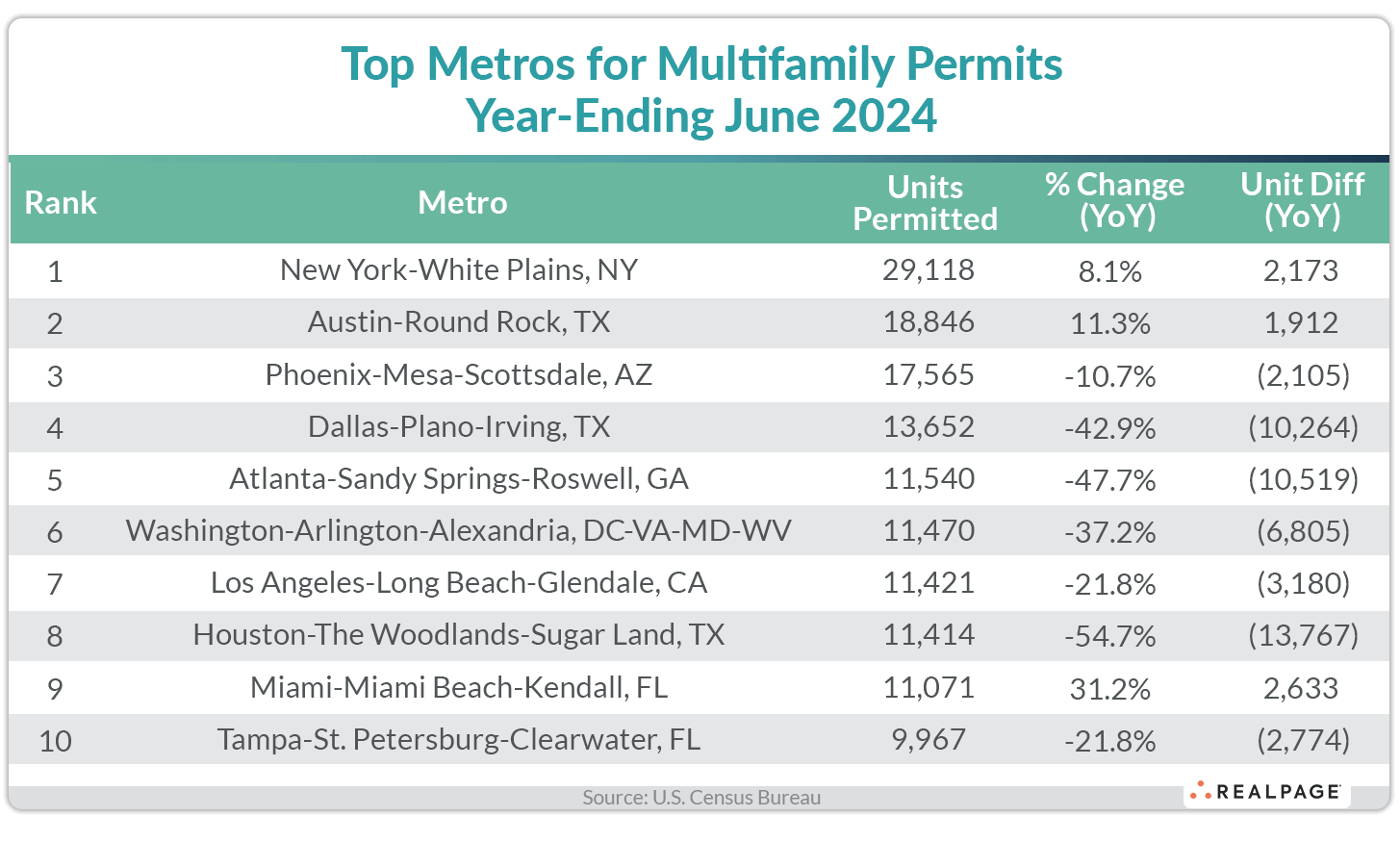

All the top 10 markets from May’s list returned in June with the first four remaining in order.

New York remained the top multifamily permitting market in the 12-months-ending in June with 29,118 units permitted, up about 8% from last year and up more than 4% from May. Austin returned at #2 with 18,846 units permitted, up about 11% from last year but essentially unchanged from last month and down about 3,000 units from a peak in January 2024.

Phoenix remained in the #3 spot, permitting a total of 17,565 units for the year, up about 3% from May but still about 11% less than last June. Multifamily permitting continues to slow rapidly in Dallas with 13,652 units permitted to remain in the #4 spot, with 10,264 units less than last year but only about 300 units fewer than May’s total.

Atlanta jumped three spots to #5 with 11,540 units permitted through June, but that was down 10,519 units from last year’s pace. Washington, DC, Los Angeles and Houston were each pushed down one spot by Atlanta to the #6 through #8 spots and each permitted close to 11,400 units each, with annual decreases of from 3,200 to 13,700 units.

Miami and Tampa returned to the #9 and #10 spots again this month but switched places, permitting 11,071 units and 9,967 units, respectively. Miami was up for the month and year, while Tampa declined for both.

All but three of the top 10 multifamily permitting markets decreased annual totals from the year before and some were pretty significant declines. Houston had the largest decrease in annual multifamily permitting of the top 10 (-13,767 units), followed by Atlanta (-10,519 units), Dallas (-10,264 units), Washington, DC (-6,805 units), Los Angeles (-3,180 units), Tampa (-2,774 units) and Phoenix (-2,105 units). New York, Miami and Austin had moderate increases of around 1,900 to 2,600 units.

Other major non-top 10 markets with significant declines in annual permitting include San Antonio (-10,497 units), Raleigh/Durham (-5,695 units), Portland, OR (-5,570 units), Minneapolis/St. Paul (-4,763 units), Jacksonville (-4,010 units), Denver (-3,836 units), Orlando (-3,423 units) and Chicago (-3,248 units).

Major markets with significant year-over-year increases in annual multifamily permitting in the year-ending June were San Diego (+4,513 units), Greensboro/Winston-Salem (+2,060 units), Knoxville, TN (+1,715 units), Ashville, NC (+1,487 units) and Fort Worth (+1,106 units).

The annual total of multifamily permits issued in the top 10 metros – 146,064 – was about 23% less than the 188,760 issued in the previous 12 months and down about 4% from last month. The total number of permits issued in the top 10 metros was almost equal to the number of permits issued for the #11 through #35 ranked metros.

Below the metro level, nine of last month’s top 10 permit-issuing places returned to this month’s list with the first five and last city remaining in the same place. The list of top individual permitting places (cities, towns, boroughs and unincorporated counties) generally include the principal city of some of the most active metro areas.

The city of Austin remained in the #1 position with 9,298 units permitted, about the same as in May. The city of Los Angeles returned to the #2 spot in June with 8,237 units permitted, 622 less than last month. The city of Phoenix stayed in the #3 spot with 7,470 units permitted, 242 units more than last month, while the borough of Brooklyn remained in the #4 spot, permitting 7,091 units.

The city of San Diego returned to the #5 spot with 6,087 units permitted, 130 units more than last month’s annual total. Mecklenburg County (Charlotte) moved up two spots to #6, permitting 5,941 units for the year, up 288 units from May. The city of Miami jumped on to the list in June at #7, permitting 5,864 units for the year, a 17% increase from last month.

Unincorporated Travis County (Austin) permitted 5,522 units to land on the #8 spot, while the city of Atlanta slipped two spots to #9 with an annual total of 5,344 units permitted. The city of Fort Worth remained in the #10 spot with 5,221 permitted units, up 208 units or 4% from May.

While Texas still accounted for six of the top 20 individual permitting places in June, the cities of Houston and Dallas and Harris County (Houston) have been moving down the list. Meanwhile, the cities of Miami, Seattle, Denver and Cleveland have been moving up. In addition to Texas’ six permitting places among the top 20, Florida, California, North Carolina and New York each had two permitting places on the top 20 list.

https://www.realpage.com/analytics/june-2024-multifamily-permit-update/